Boarding Pass

We help you travel for free. Enjoy the best deals on airfare, hotels, and more when you build your travel budget with Venti. No annual fee required.

GET STARTEDWE'RE HELPING TRAVELERS SAVE

$1 Billion

By offering a savings rate that beats every bank

How it Works

SAVING FOR TRAVEL JUST GOT EASIER

Open your digital savings account and make regular deposits to grow your travel budget. With no lock-up period, you can withdraw every dollar from your account at any time.

As your savings grow, we'll reward you with Points weekly. 1 Point = $1 towards travel. The longer you save, the more Points you earn.

Use your Points when you make purchases on Venti. Points never expire and can be transferred to friends and family. Learn more.

Deposits stored at Veridian Credit Union, member NCUA. Must be a U.S. resident over the age of 18 to open an account.

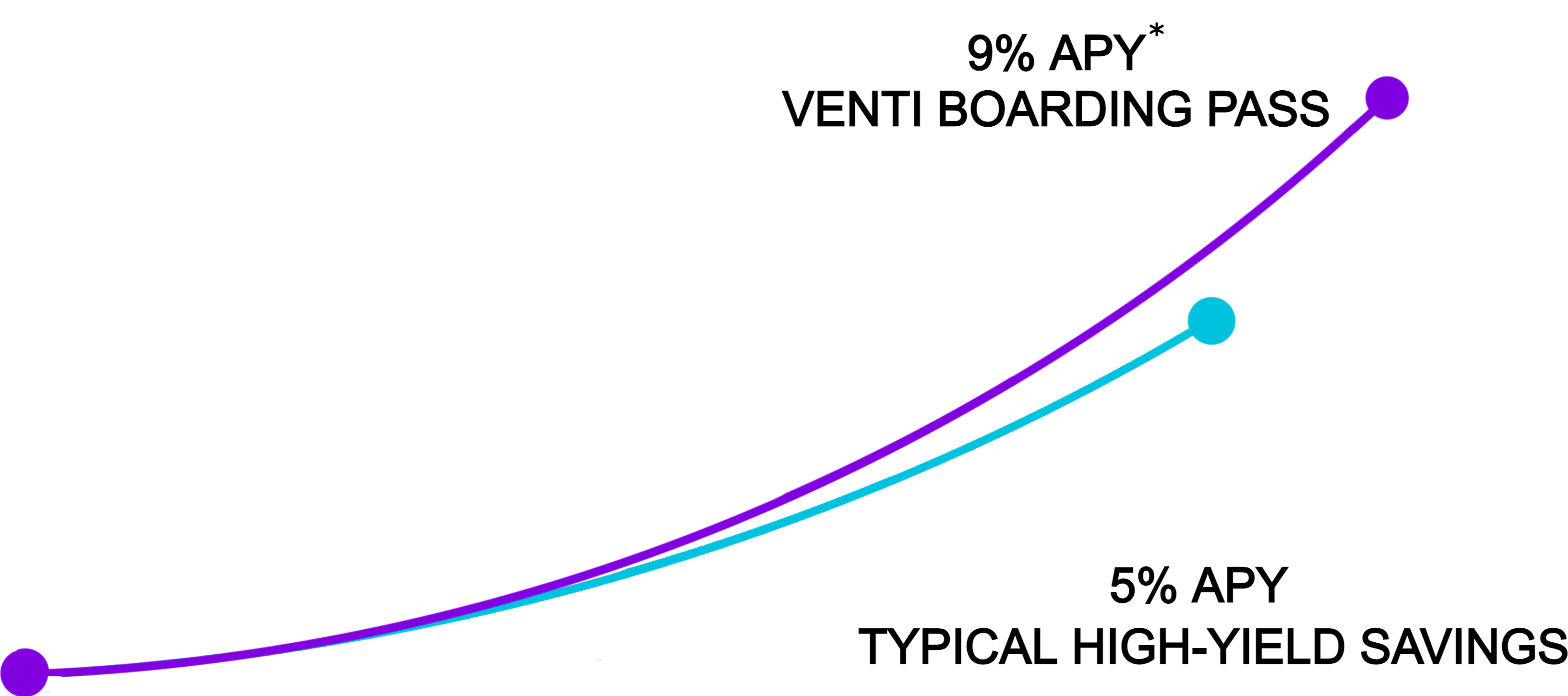

It Pays to Save

USE CASH AND POINTS TO GET THESE PRODUCTS UP TO 100% OFF

OUR POINTS CALCULATOR**

No minimum deposit required.

After 12 Months, You'll Have:

Withdrawable To Your Bank

In Travel Points

Save Big With Points

We'll Even Price Match

If you find a flight or hotel cheaper somewhere else, we'll match their price so Venti is always the best deal for you.

Terms and conditions apply

For 2024, all flights below $250 MSRP (direct carrier price) can be purchased for $0 with Points.

Search Flights (Beta)For 2024, all hotel bookings under $120 MSRP (direct vendor price) can be purchased for $1 or less. At least 115 Points is required to achieve the discount.

Search Hotels (Beta)Pricing

We'll credit your Boarding Pass with 20 Points when you make your first deposit. Receive $10 in Points for each person you invite that makes an initial deposit with your referral link.

Pro

Earn Cash and Points. Available Jan. 3

Free when you create a savings account with a Credit Union on our favorites list.

- Earn cash interest and Points

- Your name must be on bookings

- Max Points Balance: ∞

Priority

Discounted to $9.99

No Annual Fee.

Great for solo travelers, couples, travel buddies, and small families that travel together.

- Earn 9% APY on Deposits

- Your name must be on bookings

- Max Points Balance: ∞

- Max Cash Savings Balance: $7,500

- Eligible for our Venti Travel Rewards Card

Business Class

Starting at $4.99 per Account per Month.

Extend travel benefits to your employees, clients, and customers.

Learn MoreFirst Class

Discounted to $150.00 for first year. Then $500 per year.

Perfect for frequent flyers and corporate travel. Free upgrades and other perks.

- Earn 9% APY on Deposits

- Can purchase on behalf of others

- Max Points Balance: ∞

- Max Cash Savings Balance: $7,500

- Eligible for our Venti Travel Rewards Card

- Coming Soon:

- Annual Travel Insurance

- TSA Pre-Check Reimbursement

- Discounted Airport Lounges

Benefits marked with * are limited to non-discounted accounts only. Rewards back and APY percentages subject to change before and after account creation.

FAQs

It's in our DNA to be as transparent as possible

When you make a deposit onto your Boarding Pass, your funds are stored with a trusted third-party custodian that banks with Veridian Credit Union. By using Venti, you are indirectly a customer of Veridian, which is Federally Insured by the National Credit Union Administration (NCUA), a U.S. Government Agency. Deposits at Veridian are insured up to $250,000. For questions, please contact [email protected]

Absolutely! We strongly suggest you added your rewards account number during checkout to earn additional Points/miles with your favorite brands.

A Boarding Pass initiation fee of (non-recurring) is required for account verification, which is paid via credit card, and varies by package. There are no transaction fees.

We consider a taxable event is created the moment Boarding Pass Points are used to complete a purchase. We will provide a ledger in your account so you can track export for filing purposes. We recommend you speak to a tax professional to review your individual circumstances.

When you purchase travel insurance through our portal at least three times within a calendar year, you'll be able to exchange 100 Points for $100 in Cash Back.

Still Have Questions?

Say hello by reaching out via our contact page.

* Annual Percentage Yield (APY) is accurate as of 4/3/2024. Select markets only. APY is compounded and credited monthly in the form of Boarding Pass Points. Fees may reduce earnings. Rates are variable and subject to change before and after account opening.

** Calculated values assume principal and interest remain on deposit and are rounded to the nearest cent. In addition, calculated values use the current APY, which is variable and may change before and after account opening; your savings will be based on APR equivalence, so savings could be less. While there is no limit on interest earned, calculator is designed with certain limits and is for illustrative purposes only.

*** Maximum referral credit (points) is valued at $250 per year with a lifetime cap of $1,000.