About Venti Points

Boarding Pass Points ("Points") are used to "buy down" the cost of travel-related products on the Venti platform and are rewarded for meeting certain criteria. Share the savings with friends and family.

Earning Points is easy! Below are examples that allow anyone to earn Points:

- You achieved VIP status on our platform and completed your first deposit.

- You invited someone to join Venti, and they completed their first deposit.

- You maintained a Cash Balance on your Boarding Pass greater than $0 during a statement period.

- You purchased Points from your dashboard using Warp Drive.

- Someone on Venti sent you Points.

- You purchased travel on our platform as a Buddy Pass holder.

- You purchased travel insurance with an email tied to your Venti account.

Remember: 1 Point = $1 toward travel

Each activity rewards a different amount of Points. You can track how many Points you have from within your Venti account. Points do not expire and can be transferred to others on Venti.

What Are the Restrictions?

Points can only be used towards a purchase on the Venti platform. Selling your Points is against our Terms of Use and may result in an account audit. Our proprietary algorithm will determine how many Points you can use towards a transaction, which can be up to 100%. Lastly, your account will not be rewarded Points via interest disbursement if your Cash Balance was $0 for the statement period. We impose these limitations to prevent platform abuse.

You can redeem Points for cash after purchasing Travel Insurance through our portal.

How Do I Use My Points?

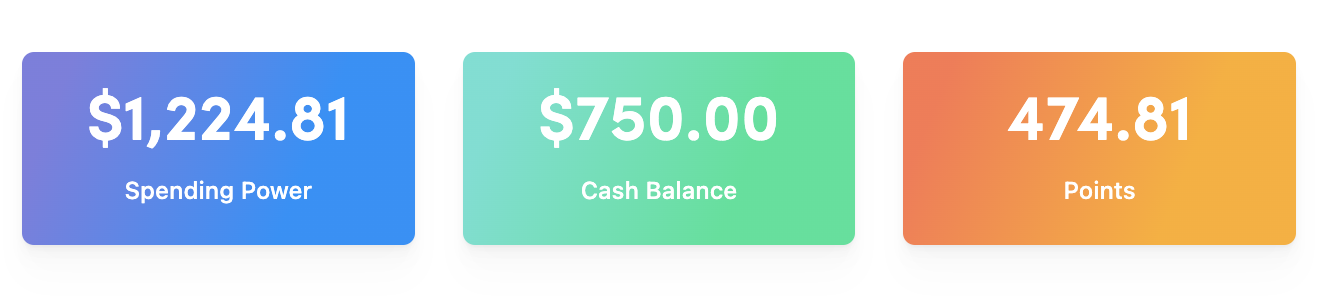

Just like your home screen, you will see the following numbers on the checkout screen when making a purchase:

- Spending Power: The total amount of cash and cash-equivalent Points you have to make a purchase with.

- Cash Balance: The amount of cash you have on your Boarding Pass, which excludes pending transactions.

- Points: The total amount of Points you have available to use towards a purchase.

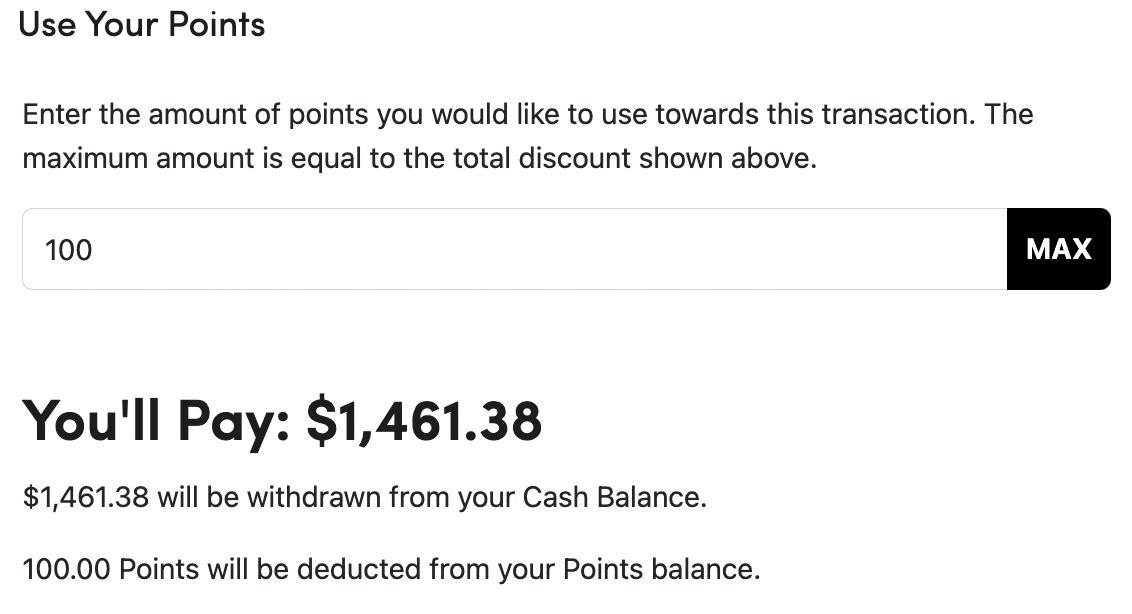

You can decide how many Points you wish to apply to the purchase's subtotal. Prior to payment, you will be presented with a breakdown of how much will be deducted from your Cash and Points balances to complete the transaction.

Points also give you an edge to win sweepstakes and other giveaways.

Example: Flight to Miami from New York

Assuming you are a single passenger flying from JFK Airport to Miami International on American Airlines. The subtotal presented by the airline is $192.80 for a round trip. Your Cash Balance is $1,000 and your Points balance is 500.

The Venti Algorithm determines that you can use 100 Points towards this flight. During the checkout screen, you decide to use the full 100 Points allowed and are presented with a new total of $92.80. After booking the flight, your new Cash Balance is $907.20, and your Points balance is 400. You scored the Miami flight for a total discount of about 52%.

What About Taxes?

We consider a taxable event to be created when you apply Points toward a purchase, which is when they are converted into "cash equivalent value." Thus, if you received 10,000 Points from a friend or family member, we will not classify the transfer as a tax event in our system, and it will not be included in your 1099-K from our ACH payments provider, Dwolla. At the beginning of each year, you'll be able to download a statement from your Boarding Pass that will provide a summary of all events deemed taxable by Venti. Venti does not offer tax advice. You must seek the consultation of a licensed tax professional to review your individual circumstances.